Contact us

- 0 890 643 240

Crisis exit strategy

How to exit a crisis by fnancing development ?

As after every crisis, companies have considerable cash needs and access to financing is very complex. That’s why it is important to put in place an effective crisis exit strategy. Although state aid exists, the best it can do is to limit damage in the short term. It is insufficient to finance far-reaching restructuring or ambitious development.

What are the solutions to exit a crisis financially ?

The main options depend on the company’s current situation, which is assumed to still be solvent at this stage, and its business project:

- Private debt

- An investor in capital or in bond debt

- A majority or non-majority “industrial” shareholder

- A mix of the above options

How does a crisis exit strategy work ?

The different stages:

- Assessment of the company’s current situation

- Identification and validation of the business project after challenging it with third parties to ensure it is feasible

- Assessment of suitable financing options

- Development of an approach that can if necessary manage several options in parallel depending on the level of urgency

- Implementation of the means to carry out the operation: human resources, documentation, service providers, processes, etc.

What are the key factors for a successful exit from the crisis ?

First of all it is key to be lucid, structured and quick to analyse and validate the project.

The quality of the external third parties is important. Their diversity is a key factor: financial consultants, lawyers, accountants, entrepreneurs, etc. It is important to define a competent advisory circle.

In a second step, the execution processes have to be calibrated and planned. In addition, the actors in these processes and the means must be clearly determined.

Then the speed of execution must be in line with what is at stake and the urgency of the project.

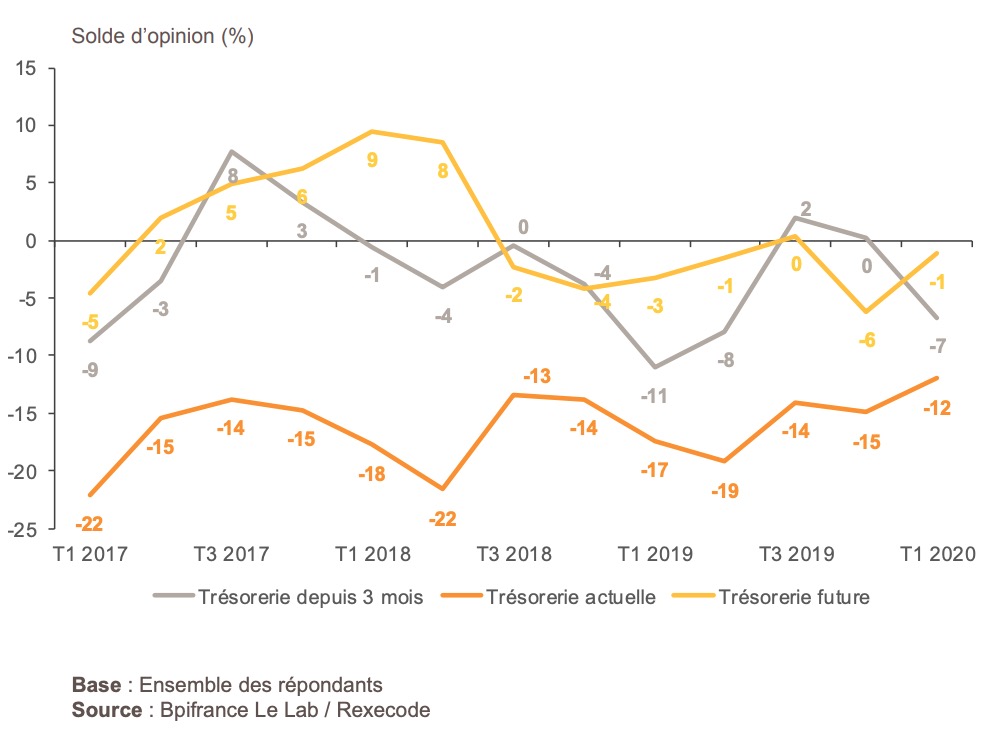

Changes in the cash position of French companies

Which investment to opt for in a crisis ?

Method for identifying the right capital investment in a crisis exit strategy ?

First, the capital investors will be selected according to the prerequisites for the project and the manager-shareholder:

- minority or majority (the manager may or may not want to be in complete control in terms of governance …)

- active or passive (they may or may not provide the manager with skills, depending on the project, in a development or structuring approach)

- short or long term (they may remain for a short period of 2 to 3 years, or longer)

Not all capital investors have the same strategy and investment criteria. Then it is a matter of negotiating the best possible conditions for the investor’s participation in the company’s capital.

The same applies to private debt and public bond debt. It is necessary to select equity investors who carry out financing using debt or bonds (convertible or non-convertible bonds, with or without equity warrants, etc.). Not all investors in equity do this.

Furthermore, if the project consists in associating with an industrial partner, then it is necessary to identify the companies which, in terms of size, skills, etc., would bring the most value to the project.

In addition, the operation must be launched as soon as the project has been defined, providing maximum visibility on the prospects for value creation. Therefore, it will be essential for companies to structure themselves to optimize recovery and development.

Nevertheless, it remains difficult to imagine what all the precise consequences of this crisis might be. However we know that we must be very agile and have the means to act.

What are the other uncertainties in the short and medium term ?

- The results of Brexit

- The tussle between China and the United States

- Presidential elections in France in 2022

- The financial bubble

- The choices of central banks

Firstly, to carry out this type of operation, it is important to be supported by a consultant who is experienced in acting in an emergency.

In addition, there are many pre-requisites to be validated: legal, fiscal, financial, economic.

RightLiens carries out this type of operation and can accompany you.